Incoterms 2025 Explained: Full Chart and Key Insights

Establishing clear rules and standards is vital for successful international trade. That’s where Incoterms come into play: standardized terms that clearly define the responsibilities, rules, and risks involved in global trade transactions.

In this article, we’ll explain Incoterms in a straightforward way, giving you a detailed overview of each term, their meanings, and the advantages they provide. Plus, we’ll help you figure out which Incoterms are the best fit for your business, with practical examples to guide you. Let’s get started!

What are Incoterms? Meaning and definition

Incoterms, short for "International Commercial Terms," are globally recognized rules that outline the obligations of buyers and sellers in international goods trade. They provide clarity on who is responsible for specific tasks, particularly in the following areas:

- time and place of delivery,

- risks and insurance,

- costs and

- customs clearance.

The Incoterms were established by the International Chamber of Commerce (ICC) in 1936 and have since become a fundamental aspect of international trade. These rules are typically revised every 10 years to stay current with global trading practices and are widely recognized by importers, exporters, freight forwarders, and carriers around the world.

According to the ICC, the Incoterms "... provide a globally valid standard for delivery terms in international transactions."

- The latest definition of Incoterms dates back to 2020.

- According to the ICC, Incoterms are used in 90% of all sales contracts worldwide.

In essence, Incoterms address and streamline common questions such as:

- When are the goods transferred from the seller to the buyer?

- Who bears which transport costs?

- Who and when does one party assume liability for loss of or damage to the goods, as well as insurance costs?

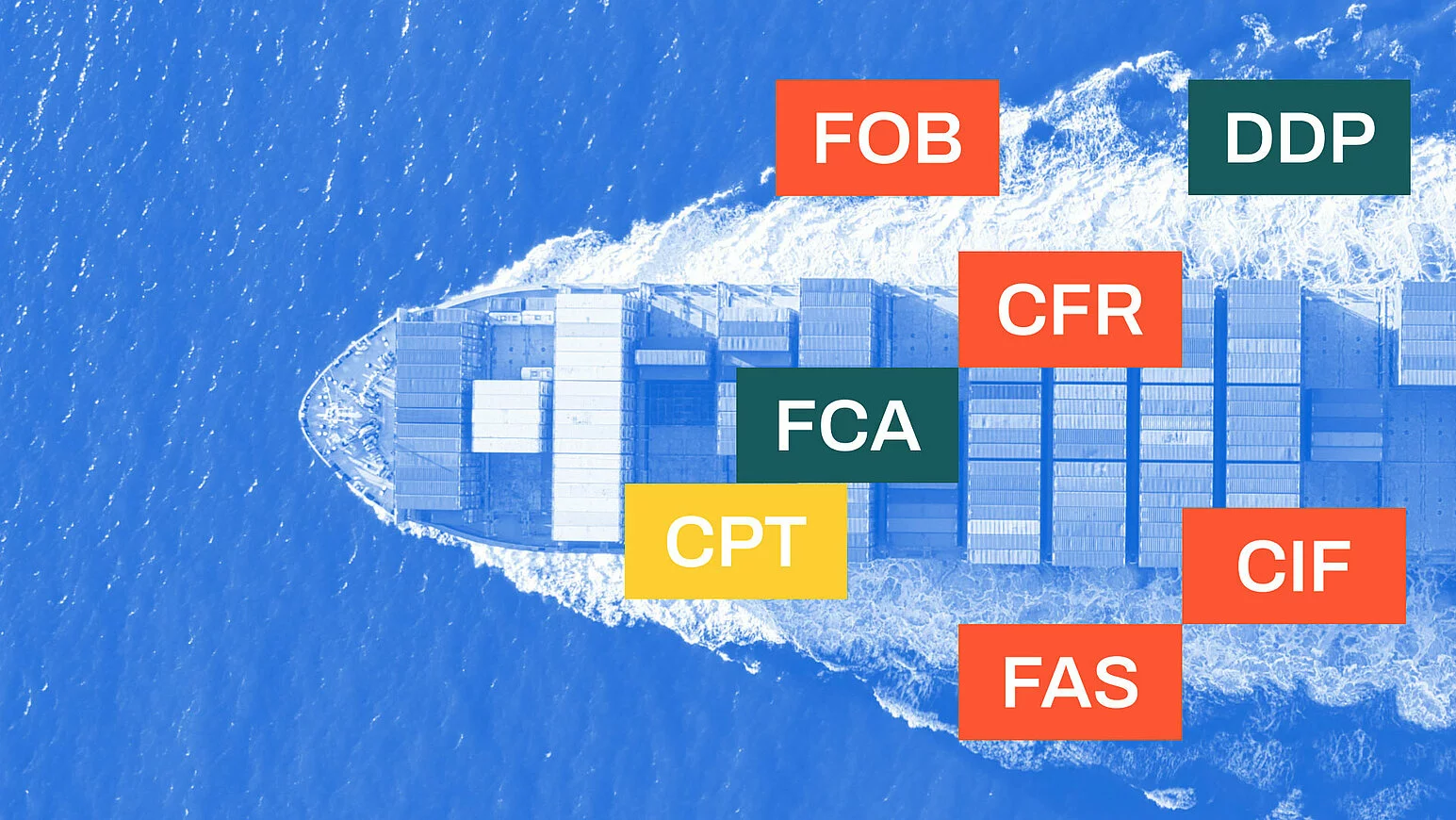

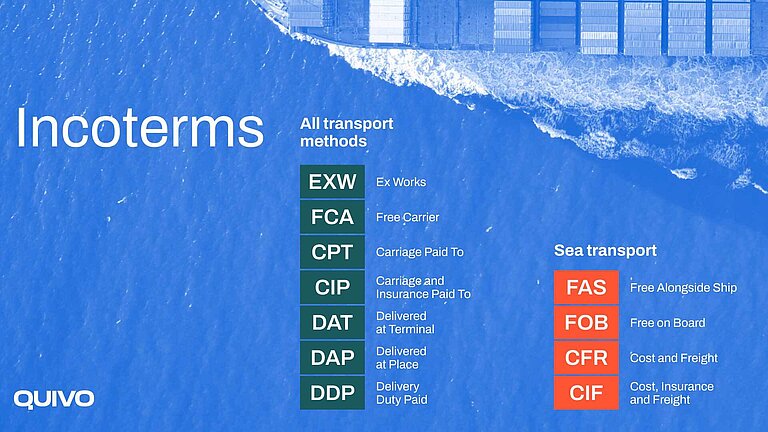

What are the eleven different Incoterms?

The Incoterms 2025 consist of eleven rules divided into two categories: those applicable to any mode of transport and those specific to sea and inland waterway transport.

For any mode of transport, incl. air freight:

- EXW (Ex Works)

- FCA (Free Carrier)

- CPT (Carriage Paid To)

- CIP (Carriage and Insurance Paid To)

- DAP (Delivered at Place)

- DPU (Delivered at Place Unloaded)

- DDP (Delivered Duty Paid)

For sea and inland waterway transport:

- FAS (Free Alongside Ship)

- FOB (Free On Board)

- CFR (Cost and Freight)

- CIF (Cost, Insurance and Freight)

Each Incoterm defines how costs, risks, and responsibilities are divided between the buyer and seller, helping businesses navigate international trade with confidence and clarity.

Categories and Groups of Incoterms

Incoterms are divided into 4 groups, with each group applicable to either all modes of transport or exclusively to sea transport:

C-clauses, also known as "dispatch clause with assumption of costs by the seller":

C-Incoterms are usually chosen when the seller assumes the transport costs up to the destination. The seller pays for the transport to a specific location, but the risk is transferred to the buyer as soon as the goods are handed over to the first carrier.

D clauses, also known as "arrival clauses":

These terms are beneficial when the seller covers the transport costs to the final destination. The responsibility and risk shift to the buyer once the goods reach their destination and are made available to them.

E-clause EXW (Ex Works), also known as the "collection clause":

EXW is the right choice if the buyer is to assume all costs and risks of transport from the seller's works. The buyer pays for everything from this point onwards and responsibility is transferred to the buyer as soon as the goods are ready for collection from the seller.

F-clauses, also known as "despatch clause without assumption of costs by the seller":

F clauses are ideal when the buyer is willing to take on the costs and risks of the main transport only. In this context, "Free" indicates that the buyer assumes the costs starting from a specific point, while the seller is responsible for the risk and costs leading up to that point.

Overview of all Incoterms in 2025, including practical examples

EXW (Ex Works)

The seller is responsible for making the goods available at their premises or another specified location (such as a factory, plant, or warehouse). From that point forward, the buyer assumes all associated costs and risks.

Example: A German machine manufacturer sells a machine to a company in Japan. The machine is made available at the seller's factory in Munich. The Japanese buyer must collect the machine and arrange transport to its location, including all transport, insurance and customs costs.

FCA (Free Carrier)

The seller delivers the goods to a carrier named by the buyer or to another named place. The seller is responsible for customs clearance of the goods for export.

Example: A French wine producer ships wine to a US dealer. The wine is handed over to a carrier in Bordeaux, selected by the retailer. The wine producer is responsible for the costs and risks up until the handoff to the carrier, after which the responsibility shifts to the retailer.

CPT (Carriage Paid To)

The seller pays the freight costs to the named destination. However, the risk is transferred to the buyer as soon as the goods have been handed over to the first carrier.

Example: An electronics manufacturer in China sells tablets to a retailer in Australia. The manufacturer pays the transport costs to the port in Sydney. However, the risk of loss or damage to the goods is transferred to the buyer at the port of Shanghai.

CIP (Carriage and Insurance Paid To)

As CPT, but with the additional obligation of the seller to take out minimum insurance against loss or damage to the goods during transport.

Example: A furniture manufacturer in Italy sells a delivery of chairs to a customer in Canada. The manufacturer pays the freight and insurance costs to the destination in Toronto. The risk is transferred to the buyer as soon as the goods are handed over to the first carrier, but the seller provides insurance against possible damage.

DAP (Delivered at Place)

The seller delivers the goods to a named place, without unloading. The seller bears all costs and risks up to this point.

Example: A mechanical engineering company in Germany sells a system to a customer in Brazil. The system is delivered to the customer's plant in São Paulo. The German seller assumes all transport costs and risks until the system arrives at the Brazilian customer's plant.

DPU (Delivered at Place Unloaded)

The seller assumes the costs and risks until unloading at the named place. This is the only clause in which the seller is also responsible for unloading.

Example: A Spanish furniture manufacturer ships a large order to a retailer in London. The goods are transported to the retailer's warehouse in London and unloaded there. The Spanish manufacturer is responsible for all costs and risks until the goods are unloaded at the retailer's warehouse.

DDP (Delivered Duty Paid)

The seller bears all costs and risks up to delivery at the named place, including customs clearance. The buyer only has to accept the goods.

Example: An electronics manufacturer in South Korea sells televisions to a retailer in Germany. The manufacturer assumes all costs and risks until the televisions are delivered to the retailer's warehouse in Berlin, including the payment of all customs duties and taxes.

Do you want to transport something? Discover our extensive range of transport services for companies: Find out more or simply write to us!

Rules for sea transport:

FAS (Free Alongside Ship)

The seller delivers the goods alongside the ship at the port of shipment. From this point onwards, the buyer bears all costs and risks.

Example: A Canadian timber supplier sells timber to a customer in Spain. The timber is delivered alongside the ship at the harbour in Vancouver. The Spanish buyer assumes the costs and risks of transport from this point onwards.

FOB (Free On Board)

The seller loads the goods onto the ship named by the buyer at the port of shipment. The risk is transferred to the buyer as soon as the goods are on board the ship.

Example: A Brazilian coffee supplier sells a large quantity of coffee to a trader in the USA. The coffee is loaded onto the ship designated by the US trader in the port of Santos. From this point onwards, the trader assumes all risks and costs.

CFR (Cost and Freight)

The seller bears the costs and freight to the port of destination. However, the risk is transferred to the buyer as soon as the goods are on board the ship.

Example: An Indian textile manufacturer sells fabrics to a buyer in the UK. The manufacturer pays the transport costs to the port of Liverpool. However, the risk for the goods is transferred to the British buyer at the port of Mumbai.

CIF (Cost, Insurance and Freight)

As CFR, but with the additional obligation of the seller to take out insurance. The seller bears the costs, freight and insurance up to the port of destination.

Example: A Japanese car manufacturer sells cars to a dealer in South Africa. The car manufacturer pays the transport and insurance costs to the port of Cape Town. However, the risk is transferred to the buyer as soon as the cars are on board the ship, but the seller provides insurance against possible damage.

How are the Incoterms used and what do they not cover?

International trade is a complicated web of regulations, responsibilities and agreements. One of the keys to simplifying this complexity are the Incoterms. These standardised contractual clauses play a crucial role in defining the obligations of buyers and sellers in global trade. They provide clear guidelines that reduce misunderstandings and make trade more efficient.

Basically, Incoterms determine who takes care of the following points:

- Goods documents: Who is responsible for obtaining the required goods documents? Who bears the costs for these documents?

- Transport documents: Who must obtain the required transport documents? Who bears the costs of preparing these documents?

- Insurance: Who is responsible for insuring the goods during the various stages of transport? Who bears the insurance costs?

- Information: Who is responsible for providing the trading partners with what information and when?

- Goods inspection: Who carries out the inspection of the goods? Who bears the costs for this inspection?

- Packaging: How should the goods be packaged? Who bears the costs for the packaging process and the packaging materials?

The following is NOT explicitly regulated by Incoterms and should therefore always be defined separately in the contract:

- Terms of payment: Who determines the terms of payment and where is the place of jurisdiction determined in the event of legal disputes?

- Transfer of ownership (note - not the same as transfer of possession!): When does title to the goods pass to the buyer, and how does this differ from when possession passes?

- Breaches of Incoterms: What happens if a party breaches its obligations under the Incoterms?

- Liability: What exclusions of liability apply to both parties under the Incoterms?

- Replacement delivery: Who is responsible for replacement deliveries if the original delivery is damaged or lost?

Incoterms are an indispensable tool in international trade. They provide a clear and precise basis for conducting cross-border business and help to reduce risks and misunderstandings. By clearly defining the obligations and responsibilities of buyers and sellers, they promote a smooth and efficient trading process.

Choosing the right Incoterms, including practical examples

Choosing the right Incoterm is crucial for your company in order to organise international trade efficiently and minimise risk.

Here are some key aspects and benefits you should consider when choosing and using Incoterms:

Analyse the needs:

- Type of goods: Consider whether the goods are sensitive, expensive or perishable. Example: Fresh food requires fast and safe transport conditions.

- Transport route: Determine whether the transport is by ship, plane, lorry or rail. Example: Heavy freight is often transported by ship, while express goods are sent by plane.

Distribution of costs and risks:

- Cost allocation: Decide which partner will bear which transport and insurance costs. Example: The seller could bear the costs up to the harbour, the buyer takes over from there.

- Assumption of risk: Clarify at what point the risk is transferred from the seller to the buyer. Example: In the case of EXW (ex works), the buyer bears all risks from the seller's factory.

Responsibilities:

- Goods documents: Determine who procures and pays for the required documents. Example: The seller provides export documents, the buyer takes care of import documents.

- Transport documents: Clarify which party provides which transport documents and bears the costs. Example: The seller takes care of the consignment note, the buyer takes care of the contract of carriage.

- Insurance: Decide who insures the goods for which stages of transport. Example: In the case of CIP, the seller insures the goods up to the destination.

Information and communication:

- Packaging requirements: Determine how the goods are packaged. Example: Sensitive electronics must be packed in shockproof packaging.

- Packaging costs: Determine who bears the costs for packaging and packaging material. Example: The seller pays for the packaging, the buyer pays for additional protective measures.

Packaging:

- Packaging requirements: Determine how the goods are packed.

- Packaging costs: Determine who will bear the costs for packaging and packaging material.

Legal aspects:

- Terms of payment: Define the terms of payment and the place of jurisdiction for any disputes. Example: Payment is made after delivery, place of jurisdiction is the country of the seller.

- Transfer of ownership: Distinguish between transfer of possession and transfer of ownership of the goods. Example: Ownership is transferred upon payment, possession upon delivery.

Conclusion: The advantages of Incoterms

- International recognition: Incoterms are recognised worldwide and ensure uniform trading practices.

- Standardisation: They provide clear and uniform rules that avoid misunderstandings.

- Increased efficiency: Clear allocation of tasks makes the trading process faster and smoother.

- Risk minimisation: Clear rules reduce the risk of disputes.

- Cost transparency: Companies can plan and control costs better.

By carefully selecting and applying the right Incoterm for your business, you can ensure that your international trade transactions run more smoothly, securely and cost-effectively.

Frequently asked questions about Incoterms 2025:

What are the FCA Incoterms in 2025?

- FCA (Free Carrier) is one of the most widely used Incoterms 2025 in global trade. Under this term, the seller is responsible for delivering the goods to a designated location, such as their own premises, a port, or a freight terminal, where they are handed over to the carrier or another party nominated by the buyer. Once the transfer takes place, the responsibility for transportation costs and risks shifts to the buyer.

- FCA is particularly advantageous for containerised shipments, offering flexibility in selecting the point of delivery. It also allows buyers to arrange their own freight, providing them with greater control over logistics, costs, and scheduling. If you compare FCA with other Incoterms in a chart, you'll see that it offers a balanced approach between seller and buyer responsibilities, making it a preferred choice for many international transactions.

What is the CPT Incoterm in 2025?

- CPT (Carriage Paid To) stipulates that the seller arranges and pays for transportation to an agreed destination. However, an important distinction is that the risk transfers to the buyer as soon as the goods are handed over to the first carrier—not when they reach the final location. This means buyers must carefully manage insurance coverage to protect the goods in transit.

- CPT is frequently used in multimodal transport, where shipments involve multiple carriers across different transport modes. It enables sellers to handle freight arrangements while ensuring that buyers assume risk management responsibilities from the moment the goods leave their hands. Looking at a comparison chart of Incoterms, CPT stands out as a convenient choice for sellers who want to take care of transportation costs while shifting risk at an early stage.

Sources

ICC - iccgermany.de

UK Gov - “Choose which incoterms are right for you”

great.gov.uk

Pictures:

Unsplash

Quivo © 2025